Social media has woven itself into the very fabric of our daily lives. A recent report highlights that the U.S. alone accounts for 302 million social media users, many navigating between various platforms.

In this digital landscape, banks and credit unions are not just participants but key players, with an American Bankers Association study revealing 88% of financial institutions (FIs) actively engage on social media. For FIs like yours, this isn’t just about jumping on the bandwagon; it’s about strategically harnessing these platforms.

In this guide, we’ll explore how your bank or credit union can effectively navigate the evolving social media realm while keeping compliance and regulations in sharp focus. Continue reading to elevate your social media presence with a blend of strategy, insight, and a touch of creativity.

the importance of social media in today’s world

Social media has become a cornerstone for building connections, disseminating information, and shaping consumer perceptions. For banks and credit unions, its impact is profound and multifaceted.

Expanding reach and building brand awareness

Social media is a powerful tool for financial institutions to amplify their brand and extend reach. It enables the crafting of a relatable brand identity and the dissemination of targeted content to connect with a broader audience.

Facilitating customer service and community engagement

These platforms transform how financial institutions interact with their customers, offering a direct channel for prompt responses and transparent communication, thereby enhancing trust and customer loyalty.

Promoting financial literacy and responsible financial habits

Banks and credit unions can leverage social media to educate their audience on financial matters, positioning themselves as knowledgeable and trustworthy advisors in the financial landscape.

Impact of social media on financial institutions

Case studies and data reveal that effective social media strategies can lead to increased customer loyalty and a more positive brand perception, demonstrating its significant influence in the financial sector.

Benefits for financial institutions

- Boost customer service: Real-time interaction enhances customer satisfaction.

- Gain customer insights: Social listening tools provide valuable feedback and market trends.

- Improve online reputation management: Actively managing your online presence can mitigate risks and shape public perception.

- Maximize brand visibility: Consistent, engaging content increases your brand’s visibility.

- Increase accessibility: Being present on various platforms makes your institution more accessible to a diverse audience.

Challenges for financial institutions

- Regulatory compliance: Navigating the complex web of financial regulations on social media is crucial.

- Cybersecurity: Protecting sensitive information and maintaining customer trust is paramount.

- Resource constraints: Allocating the necessary resources for effective social media management can be challenging.

- Expectation management: Balancing promotional content with informative, engaging posts to meet audience expectations.

choosing the right social media platforms

For financial institutions, selecting the appropriate social media platforms is crucial for effective engagement. This decision hinges on understanding your target audience’s preferences and behaviors.

Target audience

Identifying your audience — whether they are young professionals, retirees, or small business owners — is the first step. Demographics, interests, and online habits are key indicators for choosing suitable platforms.

Preferred platforms in the financial sector

| Social Media Platform | Strengths | % of FIs with accounts on this platform |

| Ideal for a broad audience, offering a mix of content types | 97% | |

| Best for professional networking and B2B engagement | 76% | |

| Twitter/X | Suitable for timely updates and quick customer service | 59% |

| Effective for engaging a younger demographic with visual content | 48% | |

| YouTube | Great for in-depth video content like tutorials and explanations | 45% |

When evaluating platforms, consider:

- Alignment with goals: Choose platforms that support your objectives, like Facebook for brand awareness or LinkedIn for thought leadership.

- Content suitability: Match content types with the platform, like visual stories for Instagram and real-time updates for Twitter.

- Resource allocation: Assess your capacity for content creation and management.

- Engagement patterns: Identify where your audience is most active and engaged.

2 important tips for crafting compelling social media content

For banks and credit unions, the content shared on social media not only reflects the brand but also plays a crucial role in engaging and educating its audience. Here are tips to craft content that resonates and captivates.

- Ensure your social media voice aligns with your institution’s overall character, whether it’s professional, friendly, or a mix of both.

- Emphasize what makes your institution unique, such as exceptional customer service or community involvement, in your content.

Content ideas

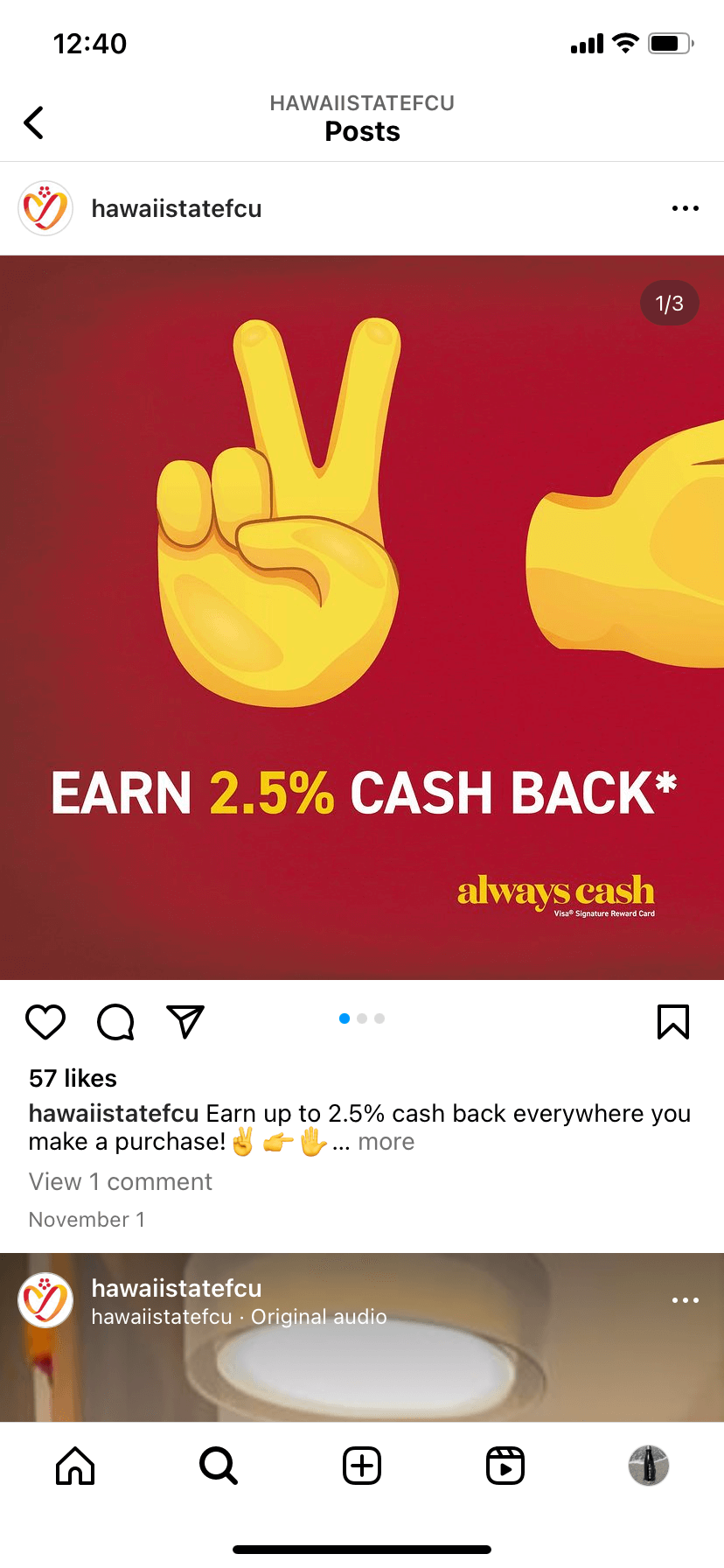

- Educational content: Share financial tips and insights to establish your institution as a valuable resource.

- Community stories: Highlight your involvement in local events and initiatives to create emotional connections.

- Interactive posts: Use polls, quizzes, and Q&A sessions to engage and learn about your audience’s preferences.

- Customer testimonials: Build trust by sharing positive customer experiences.

- Industry news: Keep your audience updated with the latest financial news and sector developments.

- Educational series: Consider a weekly series on topics like credit management or investment strategies.

- Customer spotlights: Share stories showcasing the impact of your services on customers.

- Day-in-the-life posts: Offer glimpses into the daily operations of your financial institution.

- Financial wellness tips: Regularly provide advice on budgeting, saving, and investing.

Visuals and video

- Incorporate images, infographics, and videos to make complex financial concepts accessible and engaging. Using a visual alongside your post can also improve its reach.

building a strong online community

Creating a strong online community via social media goes beyond just sharing content — it includes fostering meaningful connections and engagement with your audience. Frequently interacting, participating in relevant discussions, and encouraging user contributions can go a long way in creating a dynamic and involved community around your brand. Here are a few tips:

Engaging followers

- Promptly respond to comments, messages, and shares, showing your audience that their input is valued.

- Customize responses to individual queries and comments, making your followers feel appreciated and heard.

- Periodically ask for your audience’s opinions or feedback, enhancing engagement and understanding of their needs.

Participating in discussions

- Engage in discussions about financial literacy to educate the public and position your institution as a knowledgeable entity.

- Join relevant financial sector conversations, from regulatory changes to economic trends.

- Host webinars or live sessions on financial topics, interacting with your community in real time.

Encouraging user-generated content

- Motivate customers to share their experiences, enhancing your institution’s credibility.

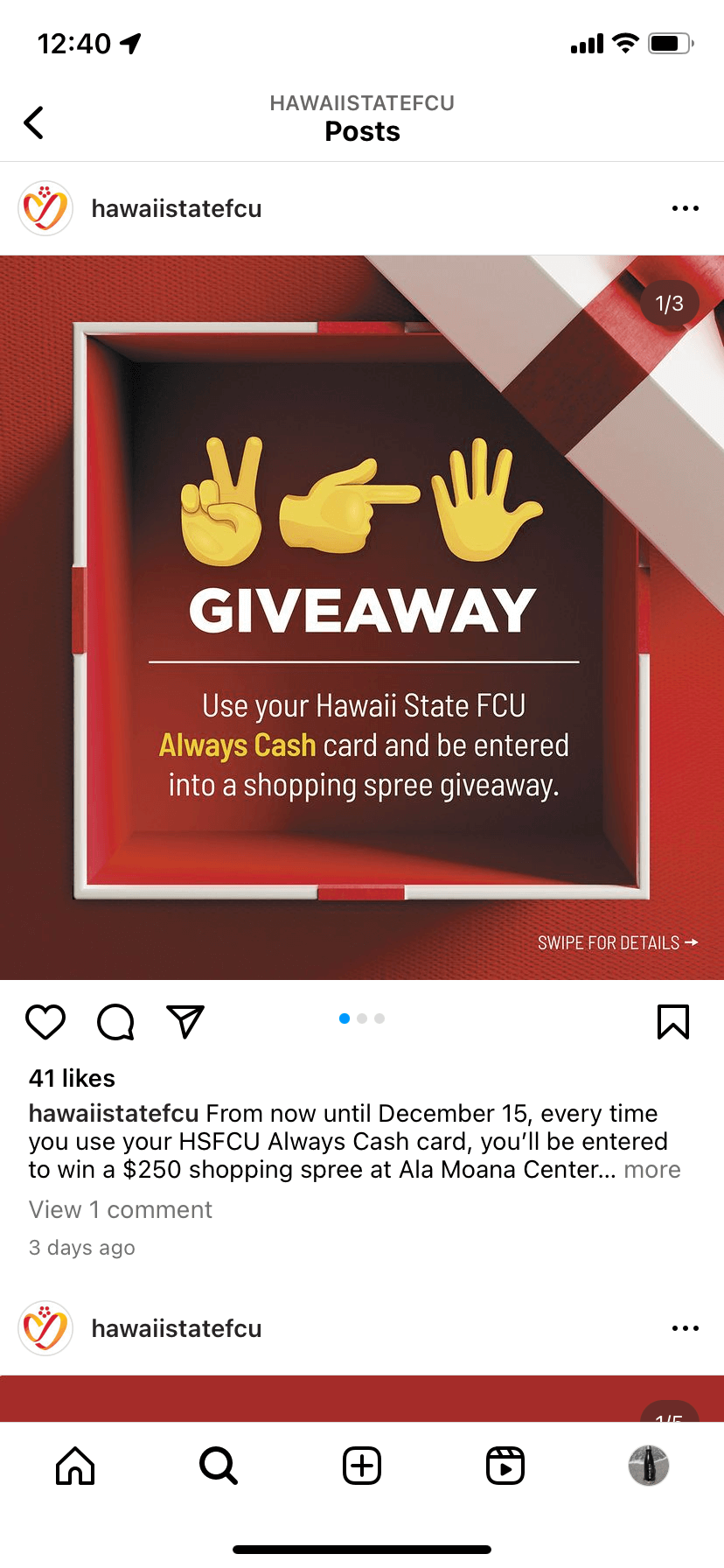

- Run social media challenges or contests related to financial wellness, spurring audience participation and content creation.

- Showcase achievements and stories from your community, from financial milestones to local business successes.

compliance and security considerations

Navigating social media in the financial sector demands a balance between effective communication and strict regulatory compliance. Banks and credit unions need to implement best practices for both compliance and security.

- FINRA standards: Adhere to the Financial Industry Regulatory Authority’s standards for communications to be fair, balanced, and complete. Ensure accuracy and completeness in all social media content.

- Clear policies and training: Establish and regularly train staff on social media policies to prevent compliance breaches.

- Content approval: Implement a rigorous process for reviewing and approving social media content, possibly involving legal and compliance teams.

- Monitoring and archiving: Continuously monitor interactions and archive communications for compliance and effective dispute resolution.

- Data privacy: Vigilantly protect customer data shared on social media, ensuring consent and compliance with data protection laws.

- Risk assessment: Regularly evaluate risks related to social media, including data breaches and cybersecurity threats.

- Cybersecurity measures: Adopt robust cybersecurity protocols, including secure passwords, two-factor authentication, and frequent security audits.

- Response plan for breaches: Develop and maintain a plan for responding to security breaches or compliance issues promptly and effectively.

By following these guidelines, financial institutions can engage on social media while upholding necessary compliance and security standards, protecting the institution, and maintaining customer trust.

measuring success and ROI

For banks and credit unions, measuring and optimizing social media effectiveness is essential. This involves setting clear metrics and key performance indicators (KPIs) to gauge outcomes and return on investment (ROI).

Key metrics and KPIs

- Profile impressions and reach track the visibility and reach of your content.

- Followers and audience growth rate help you monitor your follower count and how quickly it grows.

- Engagement rate assesses audience interaction based on likes, comments, and shares.

- Video plays show the number of times videos are played (relevant for YouTube and Instagram).

- Posting frequency, clicks, and shares help evaluate how often posts are made and their ability to drive action.

Tools for tracking and analysis

- Utilize platforms like Hootsuite or Sprout Social for in-depth metrics analysis.

- Track website traffic originating from social media using Google Analytics.

- Benchmark performance against competitors and monitor brand mentions using competitor and listening tools.

Evaluating ROI

- Align KPIs with specific business goals like brand awareness or customer engagement.

- Weigh the costs of social media efforts against the benefits.

- Regularly refine your strategy based on insights from these metrics.

Consistently monitoring these metrics against industry benchmarks and evaluating ROI enables financial institutions to measure and enhance their social media strategies, ensuring meaningful returns on their investments.

50 social media posts to use at your branch

Creating a diverse range of social media posts can keep your audience engaged and informed. Here’s a curated list of 50 post ideas to help you get started.

- Ever wonder how to make your paycheck last longer? Let’s talk about budgeting. Drop by our branch for a free budget planning session!

- Boosting your credit score can open doors to better financial opportunities. Visit our website for top tips on credit score management.

- Considering investing? Diversification is key! Spread your investments across different asset classes to reduce risk and maximize potential returns.

- It’s never too early to plan for retirement. Join our webinar this Friday to learn how you can start. Sign up on our events page!

- Thinking about buying a home? Our mortgage experts are here to help. Call us today for personalized advice!

- Saving for emergencies is crucial. Aim to build an emergency fund that covers at least 3-6 months of living expenses.

- Avoid unnecessary fees by choosing a bank account that suits your needs. Look for accounts with no monthly maintenance fees or ATM withdrawal fees.

- Need a personal loan? It’s important to understand the basics. Check out our easy guide on personal loans on our website.

- Consolidating your debt can be a smart move. Find out if it’s right for you with our latest article.

- Maximize your savings with a high-yield savings account. Visit our website to compare our latest rates.

- We’re more than just a bank. We’re part of your community! Get to know our team on the “Meet Us” page of our website (Or stop in to say hello!)

- We love supporting local events! Check out what’s happening in our community this month on our Facebook page.

- Hear directly from our customers about how we’ve helped them reach financial goals. Visit our testimonials page for inspiring stories.

- Join our free workshop on financial literacy this weekend. Great tips and tools await you. Register now!

- Proud to give back! See our recent community support activities and how you can get involved on our Community Page.

- We’re excited to announce our new [Product Name]. Head to our website to learn how it can benefit your financial planning.

- Check out our special offers this month, including exclusive deals for our valued customers. Visit our Offers page for more details.

- Love our services? Refer a friend and enjoy exclusive benefits. Details are on our Referral Program page.

- We’re hosting a contest! Amazing prizes to be won. Follow our page for upcoming details on how to enter.

- Follow us for weekly financial tips that can make a big difference in your everyday spending. Only on our Facebook page!

- Stay safe online. Check out our top tips for securing your personal financial information on social media.

- Holiday season is approaching! Read our latest blog post on how to save during the festive season.

- Ready to buy your first home? We’ve got some essential tips for first-time homebuyers. Visit our blog to learn more.

- Managing your credit card wisely is key to financial health. Find out how with our latest Facebook Live session. Tune in next Tuesday!

- New parents? Check out our guide on financial planning for your family on our website.

- Tax season is here! Join our Q&A session next week to get your tax-related queries answered. Details on our Events page.

- Winter is coming! Learn how to manage your finances effectively during the colder months with our latest article.

- Planning a vacation? Set a realistic travel budget and look for cost-saving tips, like booking in advance or considering off-peak travel periods.

- Back-to-school season can be expensive. Check out our tips for saving on school supplies and more on our website.

- Year-end is a great time for a financial review. Join our webinar to learn how to assess and plan for the next year.

- What’s your biggest financial goal this year? Vote in our poll and see what others are saying!

- Think you’re a savvy saver? Take our fun financial quiz and see how you score!

- Have a financial question? Ask us in the comments and we’ll answer in our next post!

- We love hearing from you. Share your financial success story with us in the comments!

- Saving for a big purchase? Try the 50/30/20 rule: allocate 50% to necessities, 30% to wants, and 20% to savings. Start reaching your financial goals today!

- Inflation can impact your savings and investments. Learn how to protect your finances in our latest blog post.

- Stocks 101: What are they and how do they work? Find out in our comprehensive guide for beginners.

- Estate planning is for everyone. Learn the basics and why it’s important in our latest article.

- Confused about insurance options? We break down the different types and what they mean for you.

- Ever confused by financial jargon? Our glossary post this week explains common terms in simple language.

- Our team is ready to help you with your financial needs. Have a question? Reach out to us anytime!

- We value your feedback. Let us know how we can improve our services by contacting us today.

- Read about how our team went above and beyond for our customers in this week’s feature story.

- Facing financial difficulties? We’re here to help. Contact us for support and guidance.

- Celebrating milestones with our customers! Congratulations to [Name] on reaching their savings goal!

- Did you know..? The first credit card was introduced in 1950. Check our page every Tuesday for more fun financial facts!

- “A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey. Stay motivated with our weekly financial quotes!

- Myth: You need a lot of money to start investing. Fact: You can start small. Learn more in our myth-busting series.

- Take a peek behind the scenes at our branch. See how we work every day to best serve you!

- Why did the banker switch careers? He lost interest! Join us every Friday for a dose of financial humor.

Empowering Your Financial Institutions Social Media Journey

Effective social media use is a game-changer for banks and credit unions. This includes choosing the right platforms, creating engaging content, fostering community, and staying compliant while measuring success. Remember, these efforts can significantly enhance customer connections and financial well-being.

Ready to take your social media strategy to the next level? Let The Element Group guide you. Discover our specialized marketing services tailored for financial institutions. Visit Element’s Marketing Services page to learn more.