In the last 20 years, the profitability gap between large and small businesses has more than doubled, and companies built through M&A are well poised to sit on the higher end of the curve. Organizations built in this way can take advantage of synergies, utilizing each company’s perspectives and experiences to inform business decisions. Any multiples in services or production logistics can be consolidated as well into more efficient processes. Duplicate branches can be moved into single offices, and supply chain pricing can be made more cost-effective by allowing materials to be bought in larger quantities. Overlap in employee skills is also beneficial, widening the talent base to include workers who are already trained in the field. This is true for any industry. Both large and small companies benefit during a merger or acquisition in this respect, giving each the opportunity to improve their employee pool and infrastructure.

However, when a change as big as a merger or acquisition comes along, it is easy to neglect branding and brand identity in leu of the copious operational and logistical concerns until it is too late.

In this article, we address key identifiers for mergers and acquisitions, discuss brand identity as necessary for the success of an m&a, as well as market trends and benefits to undergoing an m&a.

stats & definitions

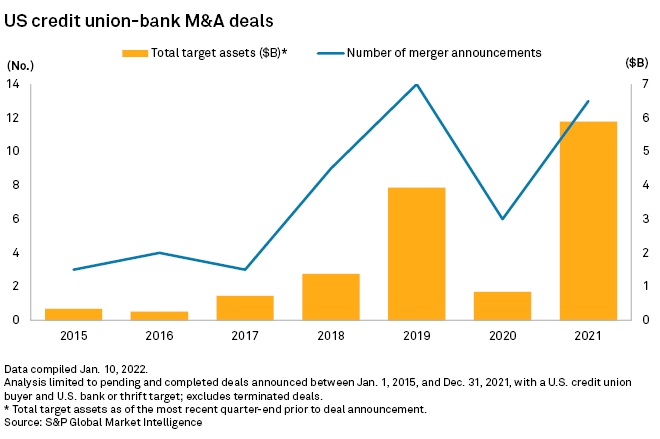

2021 was a record year for M&A, increasing over 60% in volume over such transactions in 2020, and the trends for 2022 seem to be on pace with that growth. The primary motive behind mergers and acquisitions is consolidation into a more efficient and profitable entity, with M&A revenue growth averaging at 35% today and projected to top 50% in the next few years. Buying companies benefit by being able to spur this growth in a direction they choose, tapping into the specific expertise, customer base and talent of the smaller organization and therefore broadening themselves without having to wait for organic market development. From the other perspective, institutions on the selling end can spread out market risk through the more resilient entity formed in the agreement.

Although often discussed together, mergers and acquisitions are two distinct affairs. The primary difference has to do with the balance of power between the involved companies; mergers take place between two organizations centralizing into an entirely new entity, while acquisitions take place when a larger company purchases and absorbs a smaller one into their existing institution. Both draw together the potential of the companies they start out with, and if properly handled, emerge into something stronger.

best practices

To achieve this success, certain factors must become top-of-mind before jumping to a new corporate merger and acquisition strategy; it is not an infallible procedure:

brand communication and environment: Brand communication and environment should be prioritized at all stages of the process to ensure a smooth transition into the new organization. According to a Stackpole merger paper referenced in The Financial Brand:

“Nothing is more important to the success of a merger than brand, yet it’s the thing most overlooked by financial institution leadership.”

Corporate culture clash is often a reason why M&As fail, causing the venture to succumb to incompatible policies or practices. Keeping a cohesive and functional brand together through transition is difficult, but the new, stronger entity produced through the fusion is one of the biggest returns.

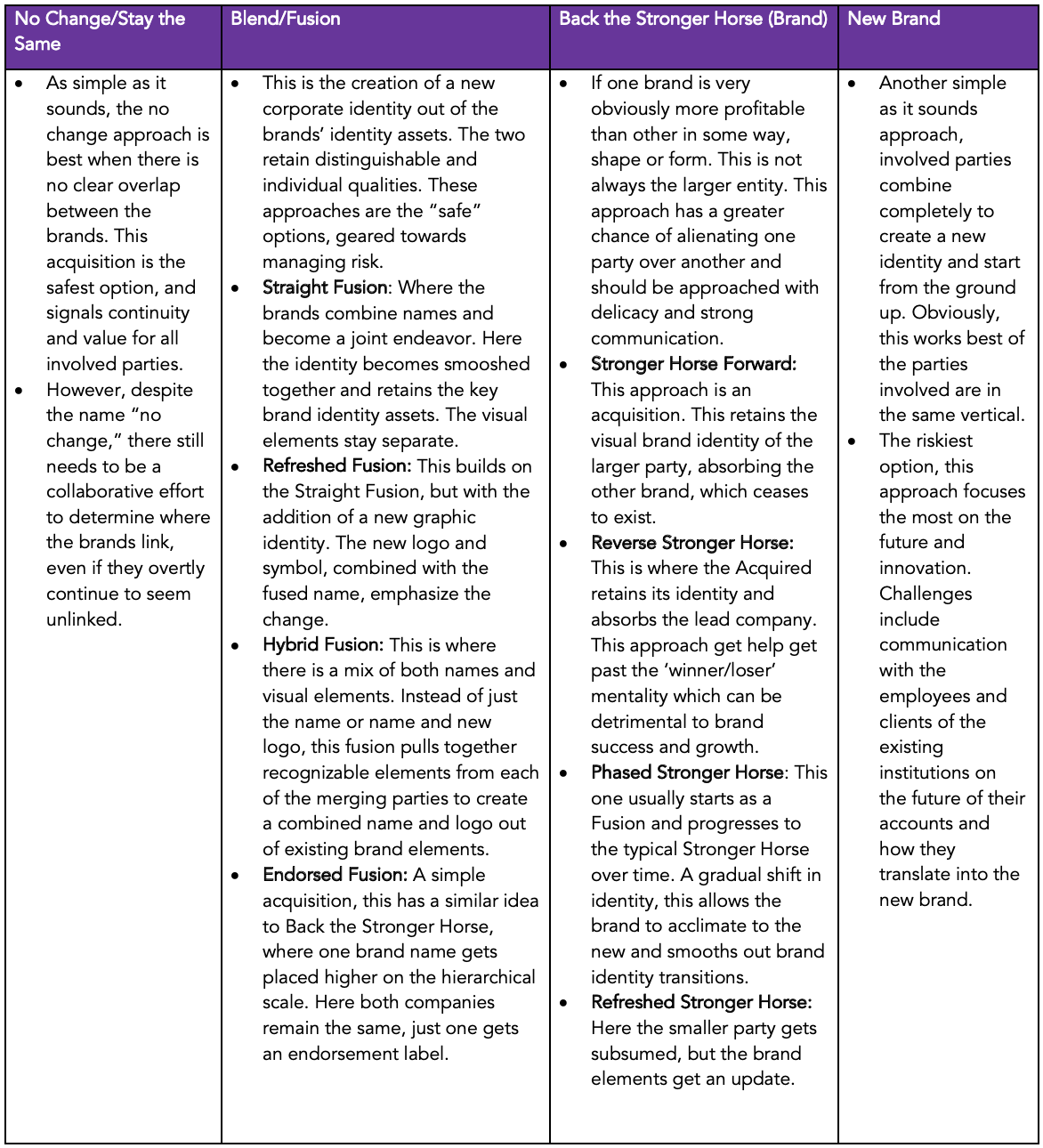

rebranding options: The broad categories define which company takes the lead are generally called, No Change/Stay the Same, Blend/Fusion, Back the Stronger Horse (Brand), or New Brand.

Maintaining a uniform public-facing brand, combined with keeping up a consistent work environment for both new swathes of employees, can be challenge and if mismanaged can bring the union under. This affects people directly involved in the organization, as well as the market reactions and perceptions surrounding the move. If the trade is not viewed favorably, such actions could cause a reduction in share values, or possibly bring the transaction under legal fire due to recently increased government regulatory scrutiny on US based mergers and acquisitions. The individual cases of the involved companies should be considered; each need to adequately measure up against any sunk costs associated with combining into a single entity.

customer consideration:

Too often, employees and clients alike are left with uncertainty about what the merged future will look like.

Often those at the front of the M&A are conscious of this need for a cohesive brand identity but end up addressing it as a “deal with the effects” approach “instead of “prevent the complications.” If there is no brand platform up-front, then the integration process is often disorganized and mismanaged. This of course, is to the detriment of the M&A, as it results in confusion for clients and for employees; the very things that should be avoided at all costs.

Brand identity can help provide clarity, and visual proof of that new identity can help those affect envision the new brand. This is emphasized by CEO Dan Kiely of Voxpro:

“Companies who keep the customer experience at the forefront during the entire process will not only [retain] current customers, but also set the organization up for future success.”

Due to the sheer number of M&A branding tracks, there needs to be a clear and strong choice about the brands direction, as well as a consciousness of the feelings of the employees and the clients that will be affected.

These decisions inform the way that the institution moves forward and allow them to keep their clients in the loop, creating an identity recognizable on all fronts. This identity should be translated and then marketed clearly and efficiently through recognizable brand identity elements. These elements include the names, logos, tag-lines, and slogans informing advertisement and media channels, digital and touch displays in branch, promotional items, graphics, and all interior design elements.

benefits and impact

benefits for its employees: Often these growing organizations, particularly during the transition period, offer many more job options and training opportunities. There are larger networks to lean on for support, and more resources available. They provide a larger variety of insurance deals, often beyond just medical insurance, as well as more accommodations in the office and perks like tuition reimbursement or training conferences. Employees are able to rise higher and achieve more in these environments, and explore a wider breadth of career options without giving up tenure in the company altogether. Because their organization does more, they are also motivated to accomplish and try more, establishing a cycle which in turn supports the company.

market competitiveness: When an M&A occurs between two similar companies already active in providing the same goods or services, the newer body holds a higher share of the market due to the reduced number of competitors; this solidifies their strength against rivals and diversifies their capabilities. Alternatively, businesses might also take another route, and buy complementary groups like suppliers or distributors to reduce their production costs. The symbiotic relationship serves both parties, producing a more self-reliant system able to sustain itself. This measurably strengthens the dependability of the supply chain and access to the services and goods which are necessary for keeping the business running. In either case, strategically intensifying or diversifying business interests through mergers or acquisitions contribute to success in the market.

tax benefits: a strategy referred to as corporate inversion allows US companies to acquire smaller foreign competitors as a way to expand themselves internationally in other markets where they can take advantage of possibly lower tax jurisdictions. Corporate inversion alleviates tax burdens by claiming this new foreign country as home base, where taxes on international profit don’t apply like they do in the US. Thus the “international” profits in the US are taxed at this lower rate, even if they make up the majority of sales. This strategy also opens the door to another foreign market, allowing a whole new direction for growth. In 2021, cross-border transactions like these made up 36% of mergers and acquisitions globally, which seems to be indicative of a burgeoning trend continuing through 2022.

There are many benefits to a merger or acquisition strategy, and when planned appropriately, it can produce excellent conditions for the business to thrive. Between larger market shares, improved synergies, and better profitability margins, this consolidated approach offers an opportunity to pull together the expertise and infrastructure of smaller firms into a company capable of dominating the market more broadly.

If you’d like to learn more about our services, or would like to discuss your own institution’s brand transformation, reach out to The Element Group today. We’re always open to helping banks and credit unions explore new solutions.

*Table Data summarized from: http://blog.finchbrands.com/10-brand-architecture-strategies-after-ma.

Written by Hannah Voteur and Bryn Baldasaro for The Element Group.