Credit union and bank floor plans are crucial architectural design components that shape member and customer experiences by driving engagement and enhancing service delivery. A strategic bank building plan, with efficient traffic flow and purposefully placed service areas, naturally guides customers, meeting their needs and encouraging them to return.

For banks and credit unions, a strategic bank floor plan is more than just a layout — it’s a blueprint for success in a competitive market.

This blog post will explore how a well-crafted floor plan can transform customer interactions, boost satisfaction, and elevate branch performance.

how does a floor plan design enhance customer engagement?

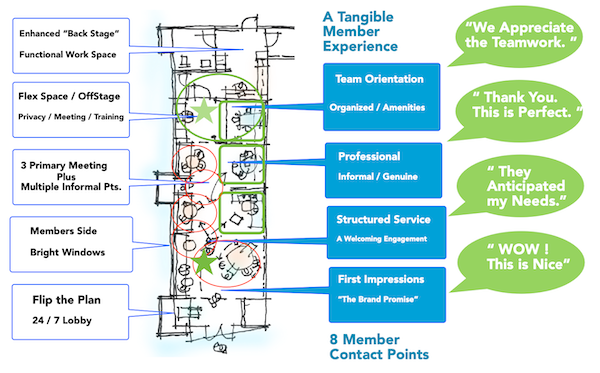

Customer engagement begins the moment someone steps into a branch, with the physical, architectural space playing a crucial role in shaping that experience. An effective floor plan balances aesthetics with functionality and can help to create a seamless and intuitive journey. By strategically placing service points and optimizing the flow of movement, banks and credit unions can ensure customers and members move easily from one interaction to the next.

An effective branch design prioritizes uncluttered, organized spaces that set a welcoming tone. When customers and members enter a well-structured environment, they are more likely to perceive the branch as efficient and customer-focused. This clarity and order make it easier for them to navigate the space and instill confidence in the services offered, leading to deeper and more meaningful interactions.

Additionally, a well-conceived floor plan can subtly guide customer behavior, encouraging them to explore additional services or products without feeling overwhelmed or pressured. By minimizing physical barriers and making information readily accessible, the design empowers customers to take control of their experience, leading to higher satisfaction and, ultimately, increased engagement.

first impressions

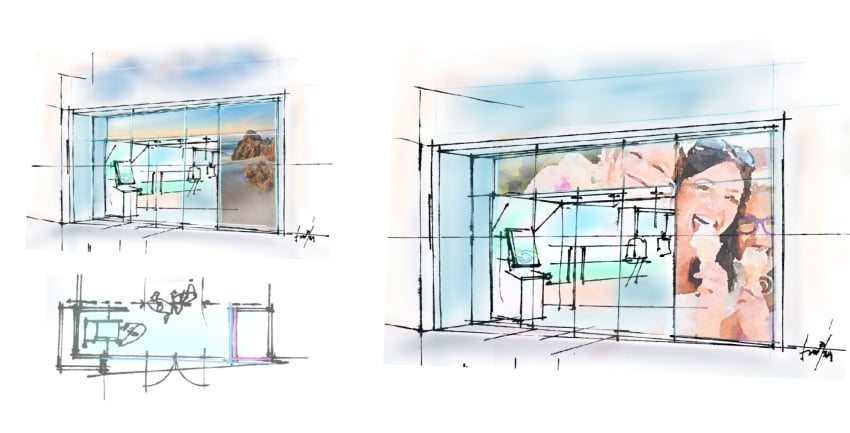

It’s also important to remember that first impressions are everything, which is why the exterior of a building can set the tone before a customer even enters its door. A well-designed exterior attracts attention while communicating brand values, professionalism, and commitment to customer service.

A well-designed exterior leaves a lasting impression. Large windows, for example, can flood the interior with natural light, creating an inviting and open atmosphere visible from the outside. This transparency enhances the building’s visual appeal and creates a seamless connection between the outdoors and the interior. With a more fluid transition from outside to inside, the space feels more approachable and welcoming, encouraging customers to feel at ease as they enter and exit the branch.

In our always-on world, around-the-clock access is crucial. By integrating ITM (Interactive Teller Machine) services into the exterior design, customers can access essential services at any time. Branches can enhance functionality and appeal by offering continuous service through strategically placed ITMs.

By focusing on exterior design and 24/7 accessibility, banks and credit unions create a strong first impression that can help attract customers. Once inside, a thoughtfully orchestrated service flow ensures this positive experience continues by efficiently guiding customers through the branch.

strategic service areas and choreography

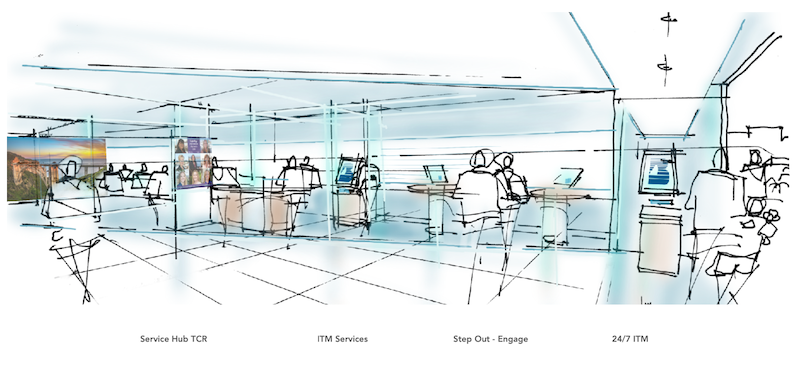

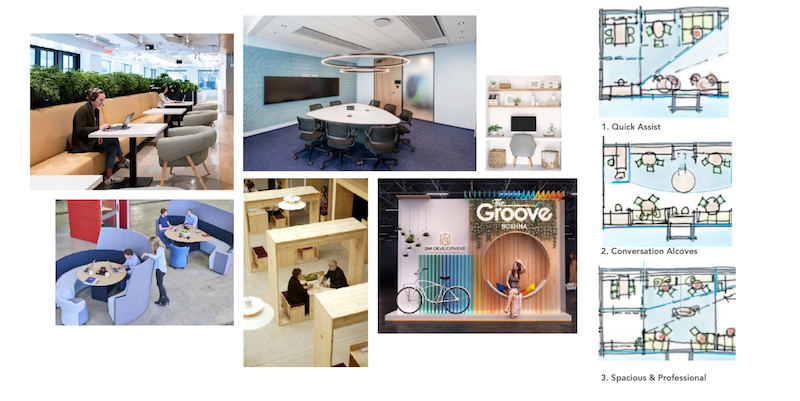

In a well-conceived credit union or bank building plan, service choreography refers to the deliberate arrangement of service areas to create a seamless customer journey. Every step, from entry to exit, should feel intuitive and stress-free. By strategically placing key service points — like conversation alcoves, quick assist stations, and ITM/TCR service hubs — banks can streamline service flow, reduce wait times, and enhance the overall customer experience.

Strategically placed ITM and TCR (teller cash recycler) service hubs can offer quick self-service options while ensuring customers still receive a personal touch when needed. The positioning of these hubs minimizes bottlenecks and keeps customer traffic flowing smoothly. It also reduces wait times and enables customers and members to handle their financial business more quickly.

Additionally, branches may choose to feature conversation alcoves and quick assist stations thoughtfully positioned for easy access. These areas provide customers with the support they need without the frustration of long queues. Designed for both comfort and functionality, they offer privacy for sensitive transactions while remaining accessible to all customers.

When banks and credit unions execute service choreography well, a routine branch visit becomes a positive, memorable experience. This careful orchestration also lays the groundwork for a consistent, branded service experience, which we’ll explore in the next section.

branded service

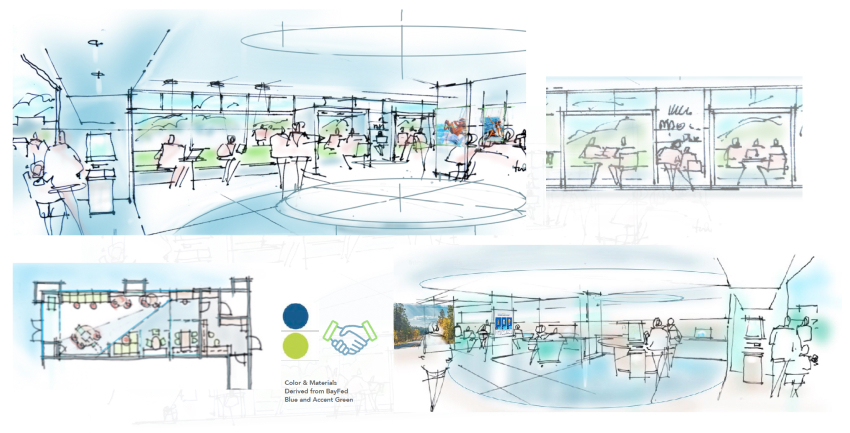

Creating a branded service experience through floor plan design is crucial for building customer or member loyalty and trust. When a branch’s physical space consistently reflects its brand, it reinforces the identity and values that customers associate with the bank or credit union. This consistency strengthens brand recognition and creates a cohesive and reassuring environment that customers can rely on.

A seamless branded service experience can be achieved by integrating signature colors and materials into every aspect of the branch design, ensuring the brand is instantly recognizable. This approach extends beyond simple aesthetics to creating an environment where customers feel the brand’s presence in every interaction, from the moment they enter the branch to the moment they leave.

Consistency in branding throughout the physical space also plays a key role in enhancing customer trust. When customers see the same branding cues — such as colors, materials, and design elements — it reinforces the message that the institution is reliable, professional, and committed to providing a high-quality experience. As a result, this helps foster a deeper connection between the customer and the brand.

By integrating branded elements thoughtfully into the design, banks and credit unions can create spaces that tell a story about who the institution is and what it stands for. This cohesive branding sets the stage for meaningful customer interactions, particularly in designated conversation places where personalized service takes center stage.

conversation places

Designated conversation places within a bank or credit union are functional areas that help foster meaningful customer and member interactions. These spaces provide the perfect setting for personalized service so branch clients can discuss their financial needs in a welcoming yet private and professional environment.

Conversation places can be designed to balance privacy with approachability, providing customers or members with comfortable spaces for in-depth discussions. Quick assist stations offer branch clients a convenient space to receive immediate help with their transactions, while semi-private consulting spaces provide space for more in-depth discussions. These areas are meant to be inviting and comfortable, ensuring customers and members feel at ease while engaging with staff.

Thoughtfully designed conversation spaces not only enhance the quality of customer and member interactions but also pave the way for future trends in bank floor plans. By embracing flexibility and innovation, these areas can significantly drive customer engagement and adapt to evolving needs.

future trends in bank floor plans

As the banking industry evolves, so do the design trends that shape member and customer experiences. Future bank floor plans will increasingly embrace technology, flexibility, and multifunctionality, driving both customer engagement and service efficiency.

Self-service technology, such as 24/7 ITM services, is becoming standard, ensuring customers and members can access essential banking functions anytime. This trend enhances branch accessibility and efficiency while freeing up staff to focus on consultative and advisory roles. By reducing routine transactions, institutions can offer personalized, high-value interactions that build stronger relationships with customers and members.

Beyond technology, banks are reimagining their physical spaces to serve as more than just transaction centers. Innovative ideas like incorporating coworking spaces, cafes, and community areas are gaining traction. These spaces invite customers or members to hang out, work, and even hold meetings, creating a more inviting and dynamic environment. Capital One, for instance, has successfully implemented café-style branches that combine financial services with the relaxed atmosphere of a coffee shop, offering customers a unique blend of convenience and community.

Another key trend is the shift toward flexible spaces within branches. Instead of rigid, one-size-fits-all layouts, future designs will prioritize adaptable areas that can be reconfigured to meet changing customer and member needs. For instance, multipurpose rooms can host financial workshops, community events, or private consultations, making the branch a true hub for the community.

The Element Group is already exploring these trends in their projects, ensuring that future bank floor plans meet evolving customer and member expectations. By thinking beyond traditional designs, banks and credit unions can transform every visit into a valuable and engaging experience.

Laying the Groundwork with Element

Strategic bank floor plans drive engagement, enhance service efficiencies, and foster loyalty. Thoughtfully integrating service choreography, branded experiences, flexible spaces, and other key elements enables banks and credit unions to create environments that exceed customer and member expectations.

Ready to take your branch design to the next level? Contact The Element Group today to explore how we can help you design engaging, future-ready bank floor plans. Schedule a consultation to discuss personalized solutions that will set your institution apart.